Create Your Paystub in 3 Easy Steps

- 1. Provide Information

- 2. Preview Paystub

- 3. Download Stub!

Creating pay stubs is no longer just a payroll task—it’s a compliance responsibility. Inaccurate or non-compliant pay stubs can delay loans, reject rental applications, trigger tax issues, and damage trust with employees or clients.

That’s why thousands of users rely on America’s most trusted compliant pay stub generator—a solution designed for accuracy, legal compliance, and speed, without the complexity of traditional payroll software.

In this complete guide, we’ll explain what makes a pay stub compliant, why 50-state tax accuracy matters, and how freelancers and small businesses can generate legally valid pay stubs in just 3 minutes.

Table of Contents

- What Is a Pay Stub and Why Is It Legally Important?

- What Makes a Pay Stub Generator “Compliant” in the U.S.?

- Why 50-State Tax Accuracy Is Non-Negotiable

- Accuracy First. Speed Always.

- Built for Freelancers, Trusted by Small Businesses

- How to Create a Compliant Pay Stub in 3 Minutes

- Why SecurePayStubs Is America’s Most Trusted Compliant Pay Stub Generator

- Common Use Cases for SecurePayStubs

- Final Thoughts: Compliance, Confidence, and Speed—All in One Tool

What Is a Pay Stub and Why Is It Legally Important?

A pay stub (also called a pay slip, check stub, or eStub) is a document that shows detailed earnings and deductions for a specific pay period. It acts as official proof of income and payroll compliance.

A legally compliant pay stub typically includes:

- Employee name and address

- Employer name and business details

- Pay period and payment date

- Gross earnings

- Federal, state, and local tax deductions

- Other deductions (insurance, benefits, etc.)

- Net pay

Many U.S. states legally require employers to provide pay stubs with specific information. Even in states where it’s not mandatory, compliant pay stubs are essential for financial verification and audits.

What Makes a Pay Stub Generator “Compliant” in the U.S.?

Not all pay stub generators are created equal. A compliant pay stub generator must:

Follow State-Specific Labor Laws

Each state has different rules about what must appear on a pay stub. Missing or incorrect details can make the document invalid.

Calculate Taxes Correctly

Federal taxes, Social Security, Medicare, and state taxes must be calculated accurately based on current tax rules.

Produce Professional, Verifiable Documents

Banks, landlords, and government agencies expect standardized, professional formats. SecurePayStubs meets all these requirements, making it one of the most trusted compliant paystub generator in the U.S.

50-State Tax Accurate. Legally Compliant. Done in 3 Minutes.

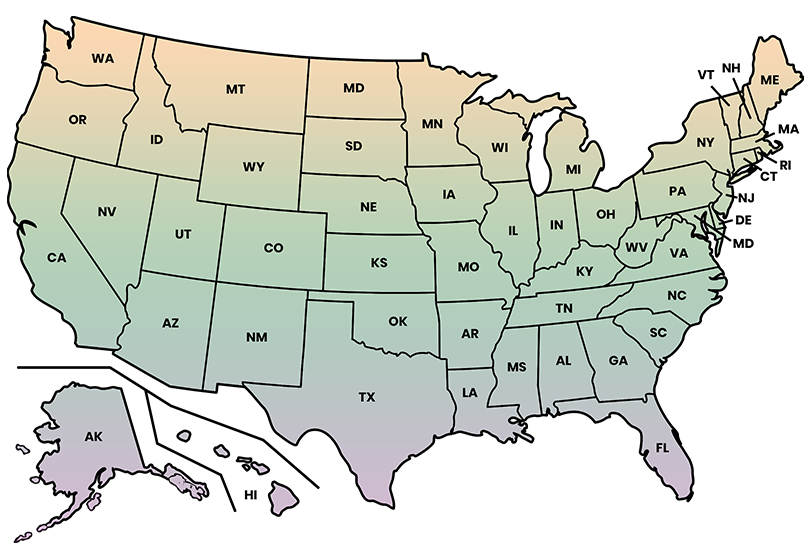

Why 50-State Tax Accuracy Is Non-Negotiable

Tax accuracy is where most errors happen—and where most problems begin. Incorrect tax calculations can:

- Trigger IRS or state tax notices

- Cause loan or mortgage rejections

- Delay background or income verification

- Lead to payroll disputes

SecurePayStubs is built with 50-state tax accuracy, automatically adjusting calculations based on the selected state.

This eliminates:

- Manual tax calculations

- Spreadsheet errors

- Guesswork with deductions

Accuracy First. Speed Always.

Many tools sacrifice accuracy for speed—or speed for accuracy. SecurePayStubs delivers both.

Accuracy First

- Verified tax calculations

- Compliance-checked fields

- Professional formatting

Speed Always

- No payroll expertise needed

- Simple step-by-step process

- Pay stubs generated in 3 minutes or less

This balance is what makes SecurePayStubs trusted by thousands of users nationwide.

Built for Freelancers, Trusted by Small Businesses

Different users, one reliable solution.

For Freelancers & Contractors

- Proof of income for rentals, loans, and visas

- Professional pay stubs without an employer payroll system

- One-time or occasional use

For Small Businesses

- Employee payroll documentation

- Consistent, compliant pay stubs

- Affordable alternative to complex payroll software

How to Create a Compliant Pay Stub in 3 Minutes

Creating a pay stub doesn’t have to be complicated.

Step 1: Enter Basic Income Details

Add earnings, pay period, and employee information.

Step 2: Select Your State

The system applies correct federal and state tax rules automatically.

Step 3: Review & Generate

Preview your pay stub, then download it instantly.

No spreadsheets. No tax confusion. No delays.

Why SecurePayStubs Is America’s Most Trusted Compliant Pay Stub Generator

Trust is built through consistency, compliance, and reliability.

SecurePayStubs stands out because it offers:

- Proven compliance across all 50 states

- High accuracy in tax calculations

- Simple interface for non-payroll users

- Fast turnaround without cutting corners

This is why it consistently outperforms generic or free pay stub generators that lack compliance safeguards.

Common Use Cases for SecurePayStubs

Users rely on SecurePayStubs for:

- Income verification

- Loan and mortgage applications

- Rental approvals

- Employee payroll records

Final Thoughts: Compliance, Confidence, and Speed—All in One Tool

When it comes to pay stubs, mistakes aren’t worth the risk.

SecurePayStubs delivers:

- Legal compliance

- 50-state tax accuracy

- Professional, verifiable pay stubs

- Results in just 3 minutes

Whether you’re a freelancer, contractor, or small business owner, this is the smarter way to generate pay stubs—without stress or uncertainty.

Create Your Compliant Pay Stub Today

Get started now and generate a legally compliant pay stub in 3 minutes.

Accuracy first. Speed always.

This article was last updated on January 22, 2026.