Create Your Paystub in 3 Easy Steps

- 1. Provide Information

- 2. Preview Paystub

- 3. Download Stub!

Introduction

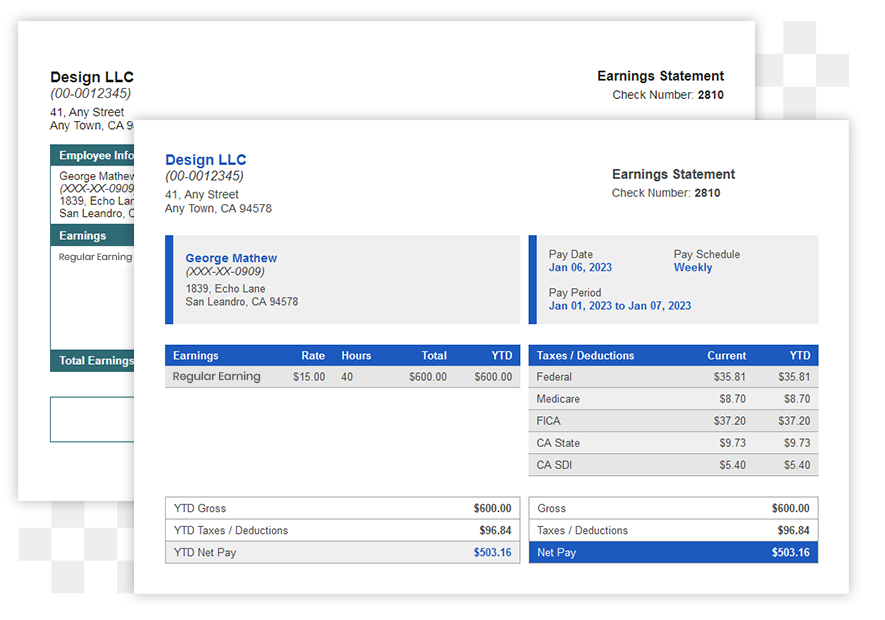

A pay stub is an official document that shows how much an employee or worker earned during a specific pay period and how that money was calculated. It breaks down earnings, taxes, deductions, and net pay, making it one of the most important payroll and income verification documents in the U.S.

Today, most pay stubs are delivered digitally. These are known as electronic pay stubs, or eStubs.

In this guide, we’ll explain what a pay stub is, what information it includes, how electronic pay stubs work, and why compliant digital pay stubs are legally accepted.

Table of Contents

What Is a Pay Stub?

A pay stub (also called a pay slip, check stub, or earnings statement) is a record provided to a worker each time they are paid. It explains:

- How much was earned (gross pay)

- What was deducted (taxes and other withholdings)

- How much the worker actually received (net pay)

Pay stubs are commonly used for:

- Income verification

- Tax filing

- Loan and mortgage applications

- Rental approvals

- Payroll recordkeeping

Why Pay stubs Are Important?

Pay stubs serve multiple purposes for both employers and employees, such as:

For Employees

- Helps them understand how their salary is calculated

- Acts as proof of income for loans, rentals, and benefits

- Shows tax withholdings and deductions for transparency

- Helps during annual tax filing

- Provides documentation for resolving payroll issues

For Employers

- Ensures payroll accuracy

- Helps maintain compliance with federal, state, and local labor laws

- Serves as a legal record of payments

- Protects employers in disputes

- Strengthens financial reporting and bookkeeping

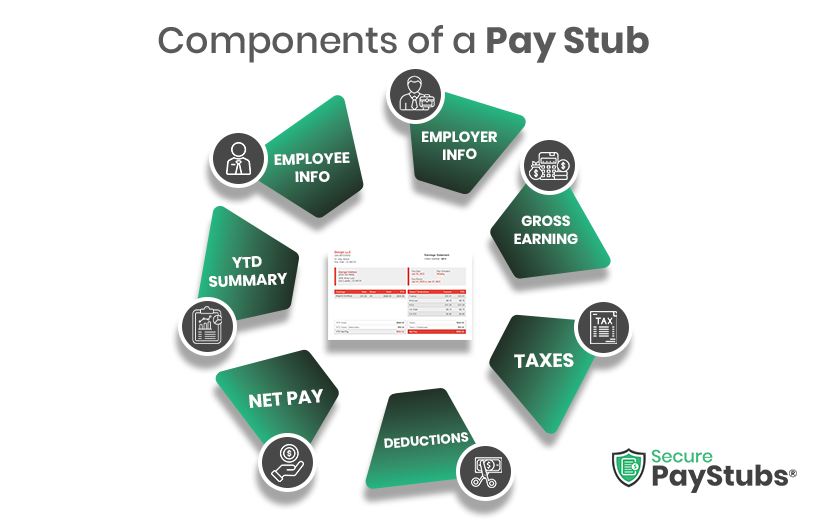

Components of a Pay Stub

A complete pay stub typically includes the following sections:

1. Employee Information

- Full name

- Address

- Last four digits of Social Security Number

- Pay period dates

- Pay date

2. Employer Information

- Company name

- Business address

- Employer Identification Number (EIN)

3. Gross Earnings

Gross pay is the total amount earned before any deductions. It can include:

- Regular wages

- Overtime pay

- Bonuses

- Commissions

- Holiday pay

- Tips

4. Taxes Withheld

- Common payroll taxes include:

- Federal Income Tax (FIT)

- Local Taxes (if applicable)

- Social Security Tax (6.2%)

- Medicare Tax (1.45%)

5. Deductions

Deductions are amounts taken from the employee’s gross pay for:

- Health, dental, and vision insurance

- Retirement contributions (401k, IRA)

- Wage garnishments

- Union dues

- Disability insurance

6. Net Pay

Net pay is what employees take home from their gross income; the pay stub clearly highlights the amount remaining after all taxes and deductions are subtracted.

7. Year-to-Date (YTD) Summary

YTD totals track:

- Total earnings

- Total taxes paid

- Total deductions

- Total net pay.

These figures help employees prepare for tax season and review annual income reports.

Types of Paystubs

Pay stubs can be delivered in two different formats:

1. Paper Printed Paystub

- Printed and given along with a physical paycheck

- A traditional method that can be expensive and take a long time

2. Online paystubs (Electronic Paystub)

An Online Paystub, often called an eStub, is a digital version of a traditional paper pay stub. Instead of being printed, it is delivered electronically—usually as:

- A downloadable PDF

- An email attachment

- A secure online payroll portal

Electronic pay stubs contain the same information as paper pay stubs and are legally valid when they meet state and federal requirements.

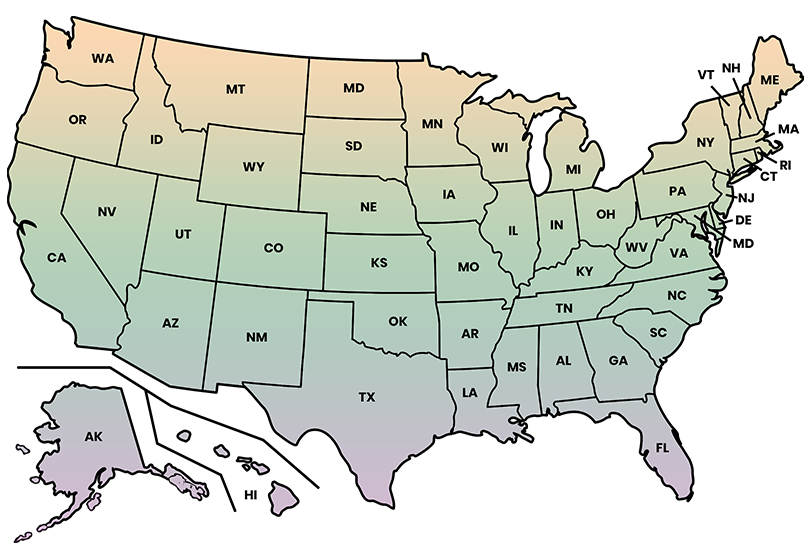

Are Electronic Pay Stubs Legal in the U.S.?

Yes. Electronic pay stubs are legal in the United States, provided they:

- Include all required pay information

- Are accessible to the employee

- Comply with state labor laws

Most states allow digital pay stubs, and many encourage them as part of paperless payroll systems.

Uses of Paystub:

Paystubs are serving many practical and legal purposes:

1. Income Verification

Used when applying for:

- Loans

- Credit cards

- Mortgages

- Rental agreements

2. Tax Filing Support

Pay stubs help employees verify:

- Total earnings

- Taxes withheld

- Pre-tax deductions

3. Employment verificatoin

Businesses may request pay stubs to confirm work history.

4. Payroll Compliance

Paystubs help employers avoid:

- Payroll mistakes

- Tax penalties

- Labor law violations

5. Budgeting & Financial Planning

Employees can use pay stubs to track spending and savings.

How to Get a Pay Stub Online

A reliable online pay stub generator should:

- Follow 50-state compliance rules

- Calculate taxes accurately

- Provide professional, verifiable formats

SecurePayStubs allows users to create legally compliant electronic pay stubs in just 3 minutes—without payroll software or manual calculations.

Key Takeaways

- A pay stub shows employee earnings, taxes, deductions, and net pay for each pay period.

- Employers are legally required in many states to provide pay stubs and maintain payroll records.

- Pay stubs are essential for income verification, tax filing, and payroll compliance.

- SecurePayStubs lets you create accurate and professional pay stubs instantly

Final Thoughts

Pay stubs play a critical role in payroll compliance and income verification. Electronic pay stubs make the process faster, more secure, and more convenient—without sacrificing legality.

When generated correctly, an eStub is just as valid as a paper pay stub.

Start creating your accurate pay stubs today with SecurePayStubs!

Need a Compliant Electronic Pay Stub?

Create a professional, legally compliant pay stub online in just 3 minutes.

Accuracy first. Speed always.

This article was last updated on January 05, 2026.